Understanding The Importance Of An IRR Calculator In Investment Decisions

In the world of finance and investment, understanding the potential return on an investment is crucial. One of the most effective ways to gauge this is through the Internal Rate of Return (IRR). The IRR is a financial metric that helps investors evaluate the profitability of investments over time. An IRR calculator simplifies this process, allowing users to quickly compute the IRR from any series of cash flows, making it a vital tool for both novice and experienced investors alike.

Investing can be a daunting task, especially when numerous variables come into play. The IRR calculator provides a straightforward approach to determine the rate at which an investment grows. By using this tool, investors can make informed decisions, comparing different investment opportunities and understanding where to allocate their resources effectively. Whether you are evaluating a new project, real estate investment, or any other financial venture, the IRR calculator can help clarify potential returns.

Technology has made investment analysis more accessible than ever. With just a few clicks, an IRR calculator can generate insights that would otherwise require complex calculations. This not only saves time but also enhances accuracy in financial forecasting. As we delve deeper into the workings of an IRR calculator, we will explore its importance, how to use it effectively, and its impact on investment strategies.

What is an IRR Calculator?

An IRR calculator is a financial tool that computes the Internal Rate of Return for a set of cash flows. It determines the discount rate at which the net present value (NPV) of all cash flows from a particular investment equals zero. This metric is key for assessing the efficiency of an investment, helping investors make informed decisions.

How Does an IRR Calculator Work?

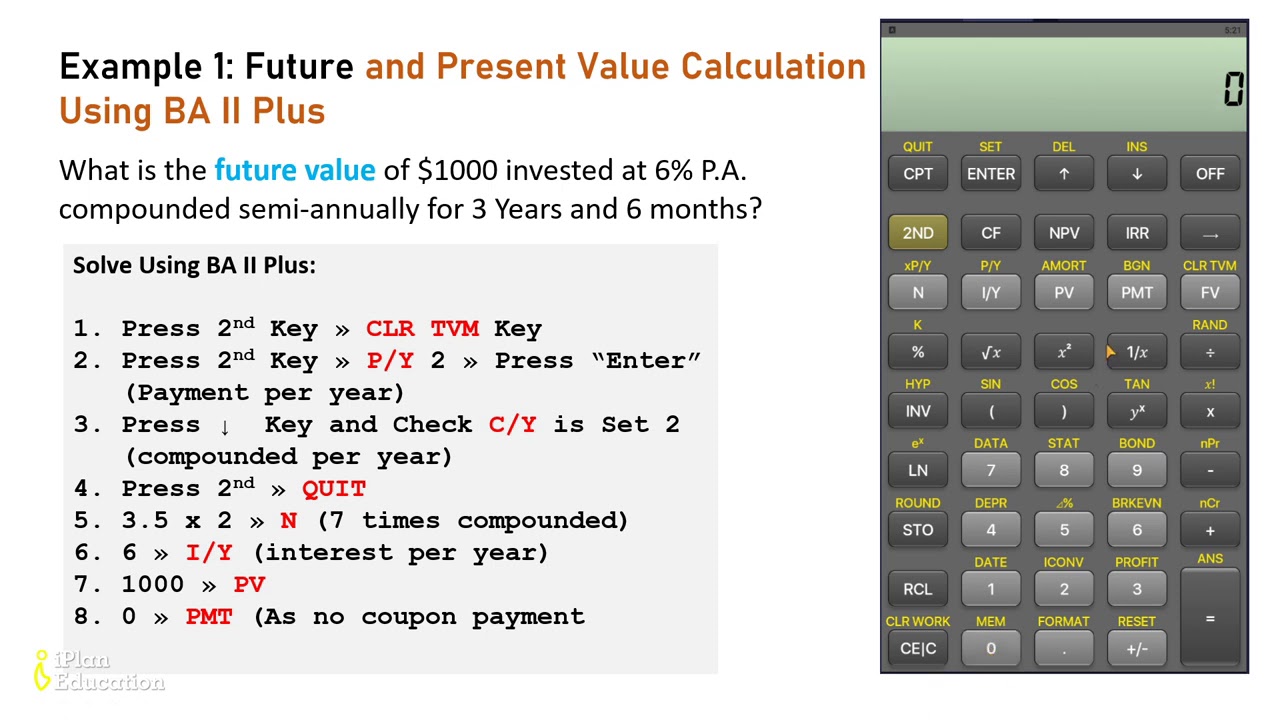

Using an IRR calculator typically involves inputting a series of cash flows, both inflows and outflows, over a specified period. The calculator then performs the necessary calculations to determine the IRR. The formula for IRR is often complex, but calculators automate this process, making it user-friendly.

Why is the IRR Important for Investors?

The IRR provides crucial insights into the profitability of investments. Here are some reasons why it's important:

- Helps compare the profitability of multiple investments.

- Guides decision-making on whether to proceed with a project.

- Assists in assessing the risk profile of an investment.

How to Use an IRR Calculator?

Using an IRR calculator is straightforward. Here’s how you can do it:

- Gather your cash flow data, including initial investment and future cash flows.

- Input the cash flows into the calculator.

- Click calculate to see the IRR.

What Are the Limitations of an IRR Calculator?

While IRR calculators are beneficial, they do come with limitations. Some of these include:

- Assumes reinvestment of cash flows at the same rate as the IRR, which may not reflect reality.

- Can be misleading with non-conventional cash flows.

- Does not provide a complete picture of investment risk.

When Should You Use an IRR Calculator?

Investors should consider using an IRR calculator in scenarios such as:

- Evaluating potential real estate investments.

- Analyzing the profitability of new business ventures.

- Comparing different investment opportunities.

Are There Alternatives to the IRR Calculator?

Yes, there are several alternatives to an IRR calculator, including:

- Net Present Value (NPV)

- Return on Investment (ROI)

- Payback Period

How Does an IRR Calculator Impact Financial Decisions?

The use of an IRR calculator significantly impacts financial decisions by providing clarity and precision in investment analysis. By enabling investors to compare the profitability of various projects, it helps in making well-informed decisions that align with financial goals.

Conclusion: Why You Need an IRR Calculator?

In conclusion, an IRR calculator is an indispensable tool for anyone serious about investing. It streamlines the process of evaluating potential investments, allowing for informed decision-making based on accurate calculations. Whether you are a seasoned investor or just starting, incorporating an IRR calculator into your investment strategy can lead to better financial outcomes.

Exploring The Vibrant Palette: Colours For The Week

Mastering The Progress Bar In Bootstrap: A Comprehensive Guide

The Fascinating World Of Normal Leg To Body Ratio

Texas Instruments BA II Plus Professional Calculator

How To Calculate Npv And Irr On Ba Ii Plus Haiper

Jean Irr Obituary Williamsville, NY