Mastering Investment Decisions With The IRR Formula Calculator

In the world of finance and investment, making informed decisions can significantly impact your portfolio's success. One of the key tools that investors and financial analysts often rely on is the Internal Rate of Return (IRR) formula. Understanding how to effectively utilize an IRR formula calculator can help you evaluate the profitability of potential investments, compare various projects, and ultimately make choices that align with your financial goals. This article explores the intricacies of the IRR formula, the importance of its calculation, and how an IRR formula calculator can streamline the process.

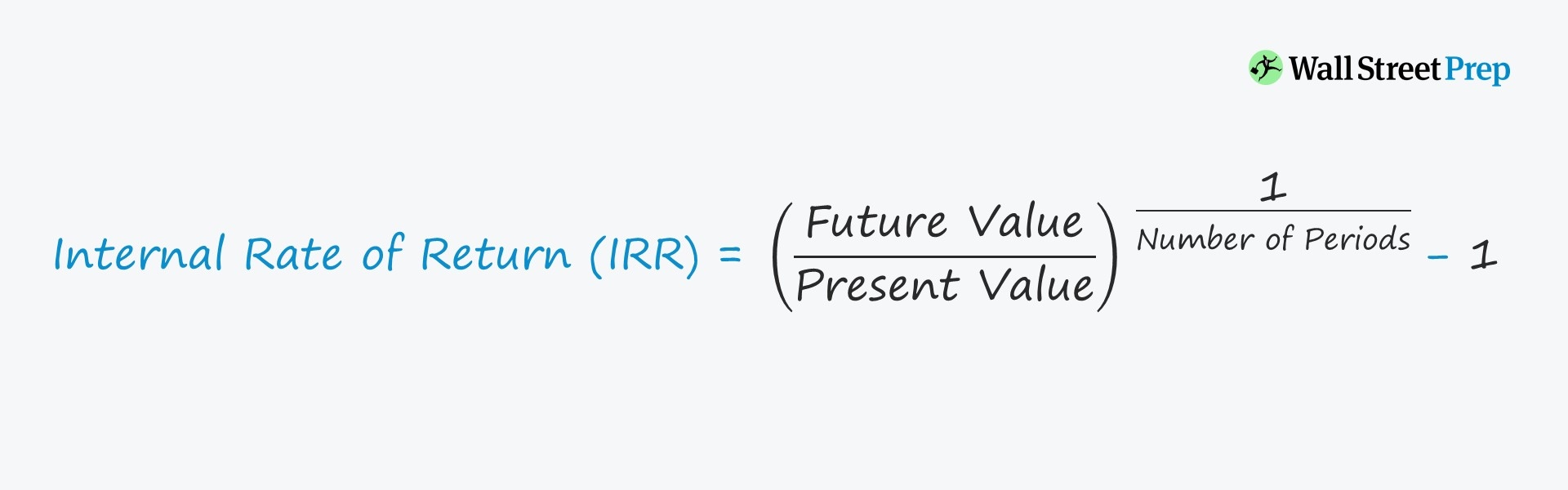

The IRR is essentially the discount rate that makes the net present value (NPV) of an investment zero. By calculating the IRR, investors can ascertain the potential return on their investment, allowing for a more informed decision-making process. This becomes particularly crucial in scenarios where multiple investment opportunities exist, and one must assess which option yields the highest return relative to risk. An IRR formula calculator simplifies this calculation, providing a quick and efficient way to analyze various investment scenarios.

As we delve deeper into the topic, we will address common questions regarding the IRR formula calculator, its applications, and how it can enhance your investment strategy. Whether you are an experienced investor or just starting your financial journey, understanding the IRR and leveraging an IRR formula calculator will empower you to make smarter investment choices.

What is the IRR and Why is it Important?

The Internal Rate of Return is a crucial metric in finance. It represents the annualized rate of return on an investment, taking into account the time value of money. The IRR is crucial for several reasons:

- Helps in assessing the profitability of investment projects.

- Facilitates comparisons between different investment opportunities.

- Provides insight into the efficiency of capital investments.

- Assists in determining the potential for future financial success.

How to Calculate IRR Using an IRR Formula Calculator?

Calculating IRR manually can be complex, but an IRR formula calculator simplifies this process significantly. Here’s how you can use one:

- Input the expected cash flows of the investment over time.

- Specify the initial investment amount.

- Click on calculate, and the IRR formula calculator will provide the IRR value.

What Are the Limitations of Using IRR?

While IRR is a valuable tool, it is not without limitations. Here are some common drawbacks:

- Assumes reinvestment of cash flows at the same IRR rate, which may not be realistic.

- Can provide multiple IRR values for non-conventional cash flows.

- Does not account for the scale of the project, potentially leading to misleading conclusions.

When Should You Use an IRR Formula Calculator?

An IRR formula calculator is particularly useful in the following scenarios:

- When evaluating multiple projects to determine the most profitable option.

- When assessing the viability of long-term investments.

- When comparing investments with different cash flow patterns.

How Does IRR Compare to Other Financial Metrics?

Understanding how IRR stacks up against other financial metrics is essential for a comprehensive investment analysis. Here’s a brief comparison:

- Net Present Value (NPV): While IRR provides a percentage return, NPV gives a dollar value, helping investors understand the actual profit.

- Return on Investment (ROI): ROI measures the total return relative to the investment cost, whereas IRR considers the time value of money.

- Payback Period: This metric focuses on how quickly an investment can pay back its initial cost, without considering cash flows beyond that period.

Can IRR Formula Calculator Be Used for Personal Investments?

Absolutely! An IRR formula calculator is not only applicable to corporate investments but can also be beneficial for personal finance decisions:

- Evaluating the potential return on rental properties.

- Assessing the profitability of stocks or bonds.

- Planning for retirement savings and investment growth.

How to Choose the Right IRR Formula Calculator?

With numerous IRR formula calculators available, selecting the right one is crucial for accurate results. Consider the following factors:

- User-friendly interface for easy navigation.

- Ability to handle complex cash flow scenarios.

- Additional features such as NPV calculation or graphical representations.

Conclusion: Enhancing Your Investment Strategy with IRR

In conclusion, the IRR formula calculator is an invaluable tool for anyone involved in investments. By understanding its benefits, limitations, and applications, you can leverage this calculator to make more informed financial decisions. Whether you're evaluating potential projects or comparing investment options, mastering the IRR will undoubtedly enhance your investment strategy and lead to better financial outcomes.

Understanding Perfect Competition In Economics

Understanding Business Goodwill Valuation: A Comprehensive Guide

Understanding Ordinal Variables Examples In Everyday Life

Irr Formula

How To Calculate Irr Calculator Haiper

IRR Calculator Find the Internal Rate of Return Inch Calculator