Understanding Present Value Cash Flows: A Comprehensive Guide

In the world of finance, the concept of present value cash flows holds immense significance. It serves as a cornerstone for evaluating investment opportunities, determining the worth of future cash inflows, and making informed financial decisions. Essentially, present value cash flows allow investors and analysts to understand how much a series of future cash inflows is worth today, taking into account factors such as interest rates and time value of money. This fundamental principle helps in assessing the profitability and viability of various financial projects, investments, and business ventures.

When discussing present value cash flows, one must consider the time value of money, which states that a dollar today is worth more than a dollar in the future due to its potential earning capacity. This principle highlights the importance of discounting future cash flows to arrive at their present value. By doing so, investors can make better comparisons between different investment opportunities and choose the ones that yield the highest return on investment.

Moreover, understanding present value cash flows is essential for financial planning and budgeting. Individuals and businesses alike can benefit from this knowledge by accurately forecasting their cash flow needs and making strategic decisions to enhance their financial stability. In this article, we will delve deeper into the concept of present value cash flows, exploring its calculation, significance, and practical applications in real-world scenarios.

What Are Present Value Cash Flows?

Present value cash flows refer to the current worth of a series of future cash flows, discounted back to the present using a specific interest rate. In simpler terms, it answers the question: how much are future cash inflows worth today? This is critical for investors who need to evaluate the attractiveness of an investment based on the potential returns it may generate over time.

How Is Present Value Cash Flow Calculated?

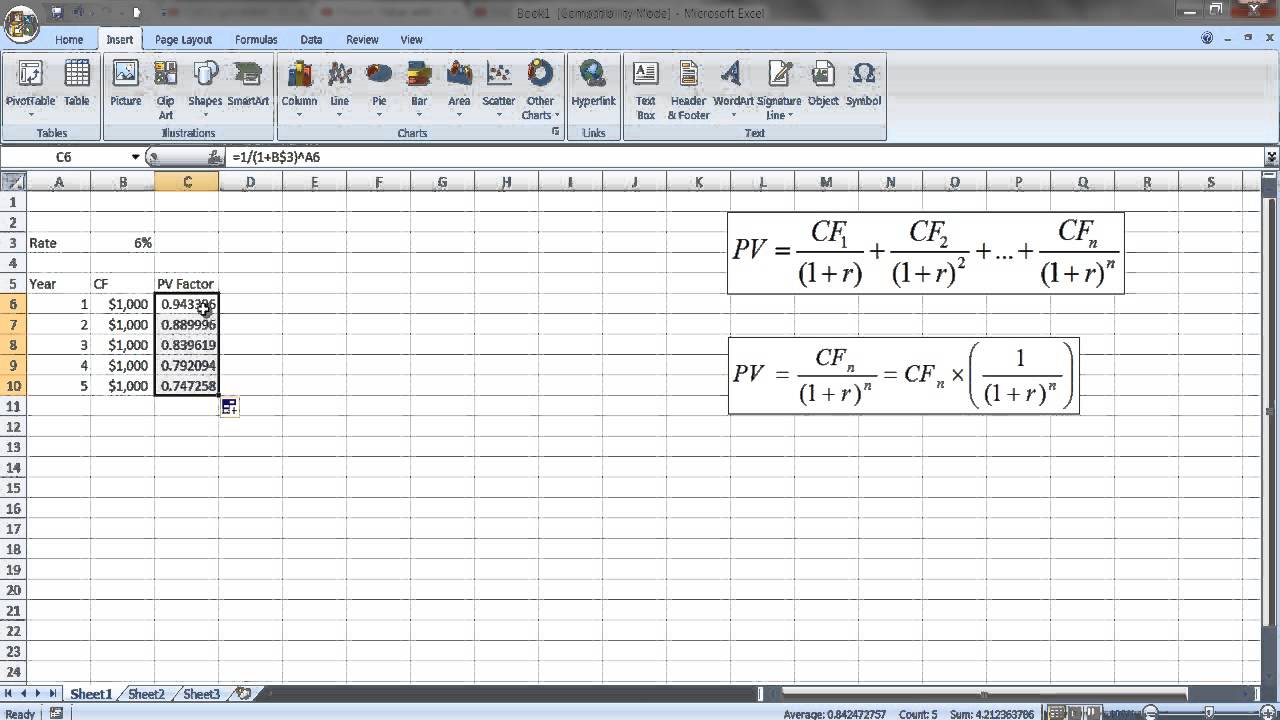

The calculation of present value cash flows involves a few key components, including:

- Future Cash Flows (CF): The expected cash inflows from an investment.

- Discount Rate (r): The interest rate used to discount future cash flows back to their present value.

- Time Period (t): The number of time periods until the cash flow is received.

The formula for calculating present value (PV) is as follows:

PV = CF / (1 + r)^t

This formula can be applied to each cash flow in a series to determine its present value, and the total present value is the sum of all individual present values.

Why Are Present Value Cash Flows Important?

Understanding present value cash flows is crucial for various reasons:

- Investment Valuation: It helps investors assess the worth of potential investments and make informed decisions.

- Comparative Analysis: Investors can compare different investment opportunities by evaluating their present values.

- Financial Planning: It aids in budgeting and forecasting future cash flow needs.

- Risk Assessment: Understanding the present value of cash flows can help in evaluating the risks associated with certain investments.

How Do Present Value Cash Flows Help in Financial Planning?

Present value cash flows are a valuable tool for financial planning as they allow individuals and businesses to:

- Determine the feasibility of projects based on expected returns.

- Make strategic decisions regarding investments, savings, and expenditures.

- Plan for future cash flow needs and ensure financial stability.

What Factors Affect Present Value Cash Flows?

Several factors can influence the present value cash flows, including:

- Interest Rates: Higher discount rates reduce the present value of future cash flows.

- Time Period: The longer the time period until cash flows are received, the lower their present value.

- Uncertainty of Cash Flows: The reliability of future cash flows can affect their present value.

How Do Present Value Cash Flows Apply in Real Life?

Present value cash flows have numerous real-life applications, including:

- Valuation of bonds and stocks based on future cash flow expectations.

- Assessment of real estate investments by calculating future rental income.

- Estimation of retirement savings needs by determining the present value of future expenses.

Can Present Value Cash Flows Be Used for Personal Budgeting?

Absolutely! Individuals can use the concept of present value cash flows for personal budgeting by:

- Estimating future expenses and determining how much to save today.

- Evaluating the potential returns on investments or savings accounts.

- Making informed decisions about loans and credit based on repayment terms.

Conclusion: Mastering Present Value Cash Flows

In conclusion, present value cash flows are a fundamental concept in finance that plays a critical role in investment analysis, financial planning, and budgeting. By understanding how to calculate and analyze present value cash flows, individuals and businesses can make more informed financial decisions, ultimately leading to greater financial stability and success. As the financial landscape continues to evolve, mastering this concept will remain an essential skill for anyone looking to navigate the world of finance effectively.

Punitive Attitude: Understanding Its Meaning And Implications

Unveiling The Mystery: How Many French Irregular Verbs Are There?

Understanding The Analysis Of Variance F Value: A Comprehensive Guide

Present Value Formula Calculator (Examples with Excel Template)

Present Value Multiple Cash Flows in Excel YouTube

PPT Chapter 3 Present Value and Securities Valuation PowerPoint Presentation ID3017367